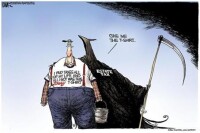

关于Asset: americans standing for the simplification of the estate tax

资产:支持简化遗产税的美国人

ASSET 是一家致力于改革美国遗产税制度的非营利组织。该组织由一群私营企业主和家庭农场主创立,他们厌倦了阻碍他们将资产传给子孙后代的复杂繁重的遗产税法。

遗产税,也称为“死亡税”,是对个人死后财产转让征收的联邦税。目前的遗产税税率为 40%,这意味着在个人死后,政府最多可以收取其 40% 的资产。

ASSET 认为这个制度是不公平和不公正的,特别是对于多年来努力建立自己的企业的小企业主和家庭农民。这些人的大部分财富通常都集中在土地、建筑物、设备和其他经营业务所必需的资产上。当他们去世时,这些资产需要缴纳遗产税,这可能会迫使他们的继承人出售部分企业,甚至完全关闭。

为了解决这个问题,ASSET 提倡改变遗产税的征收方式。 ASSET 建议使用“结转基础”系统,而不是根据死亡时的总价值对遗产征税,继承人将按照当前市场价值而不是原始成本基础继承财产。这将消除与评估遗产相关的许多复杂情况,并降低纳税人的合规成本。

ASSET 还支持提高豁免水平,以便更多家庭可以完全避免支付任何联邦遗产税。目前设定为每人 1100 万美元(每对夫妇 2200 万美元),这些免税水平意味着每年每 500 个遗产中只有大约 1 个欠联邦税。

除了通过游说美国各地的立法者来倡导州和国家层面的政策变化; ASSET 提供有关遗产税改革的教育资源,以帮助个人和家庭更好地了解遗产税对其业务和资产的影响。

ASSET 致力于改变小企业主、家庭农场主和其他受遗产税影响的美国人的生活。通过倡导改变征收遗产税的方式,ASSET 希望简化流程,让人们更容易将辛苦赚来的资产传给子孙后代。

已翻译